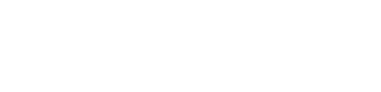

Investments

Invest in a better future! With our new personalized investments platform* you can invest to secure a better future for yourself, and what you care about.

- Digital platform that is designed to help build long-term wealth through investing in stocks, bonds, and ETFs

- Conveniently included in the PFCU mobile & digital banking app

- Tailored to your risk tolerance and preferences

- *Investments provided in partnership with Eko Investments Inc. Investments are not insured by the NCUA, are not a deposit, and may lose value

E-Statement

Electronic statements are the quickest and safest way to view your monthly PFCU account statement(s).

- No need to wait for mailed paper statements

- Getting E-statements under Home Banking is safe and secure

- You receive your statements at least one week before mailed statements arrive

- Save a tree – reduce paper waste

- View your account and loan statements online in a secure environment, 24/7

- Your E-Statements include check images for your convenience

- We just need an email address—we will send an email to let you know when your statement is available to view online

- Access at least 12 months of statement history online—save statements to a folder on your computer for your record-keeping purposes

- Cost effective—E-statements save the credit union resources so we can pass on more savings to you

You can easily sign up for E-statements while in Home Banking. Click on the Statements tab and click on the “Start E-Statements” choice. That is all there is to it! Sign up for E-statements and get the safest, quickest statement delivery while saving trees!

You’re in control – To switch back to mailed paper statements: In Home Banking click on Statements tab, click on the “Stop E-Statements” choice

Digital Banking

- Send money to family and friends with Zelle®

- Link external accounts and transfer funds

- Start conversations with our staff for help

- Intelligent budgeting and spending tracker

- Interactive cash flow and goal setting tools

- Build and monitor your net worth

Next Day Clearing

FUNDS AVAILABILITY POLICY DISCLOSURE

YOUR ABILITY TO WITHDRAW FUNDS

Platinum Federal Credit Union’s policy is to make funds from your check deposits available to you on the first business day after the day we receive your deposit. Cash and Electronic direct deposits will be available on the day we receive the deposit. Once they are available, you can withdraw the funds in cash and we will use the funds to pay checks that you have written.

For determining the availability of your deposit, every day is a business day, except Saturdays, Sundays, and federal holidays. If you make a deposit before the end of business day, on a business day that we are open, we will consider that day to be the day of your deposit. However, if you make a deposit after end of business day or on a day we are not open, we will consider that the deposit was made on the next business day we are open.

Longer Delays May Apply

In some cases, we will not make all of the funds that you deposit by check available to you on the first business day after the day of your deposit. Depending on the type of check that you deposit, funds may not be available until the second business day after the day of your deposit. The first $275 of your deposits, however, will be available on the first business day.

If we are not going to make all of the funds from your deposit available on the first business day, we will notify you at the time you make your deposit. We will also tell you when the funds will be available. If your deposit is not made directly to one of our employees, or if we decide to take this action after you have left the premises, we will mail you the notice by the day after we receive your deposit.

If you will need the funds from a deposit right away, you should ask us when the funds will be available.

In addition, funds you deposit by check may be delayed for a longer period under the following circumstances:

- We believe a check you deposit will not be paid

- You deposit checks totaling more than $5,000 on any one day

- You deposit checks not made payable to you

- You redeposit a check that has been returned unpaid

- You have overdrawn your account repeatedly in the last six months

- There is an emergency, such as failure of computer or communications equipment

We will notify you if we delay your ability to withdraw funds for any of these reasons, and we will tell you when the funds will be available. They will generally be available no later than the seventh business day after the day of your deposit.

Special Rules for New Accounts

If you are a new member, the following special rules will apply during the first 30 days your account is open.

Funds from electronic direct deposits to your account will be available on the day we receive the deposit. Funds from deposits of cash, wire transfers, and the first $6,725 of a day’s total deposits of cashier’s, certified, teller’s, traveler’s and federal, state, and local government checks will be available on the first business day after the day of your deposit if the deposit meets certain conditions. For example, the checks must be payable to you. The excess over $5,000 will be available on the seventh business day after the day of your deposit. If your deposit of these checks (other than a U. S. Treasury check) is not made in person to one of our employees, the first $5,000 will not be available until the second business day after the day of your deposit.

Funds from all other check deposits will be available on the seventh business day after the day of your deposit.

Account Access

Access your accounts at PFCU 24 hours a day with Home Banking or 1-877- PFCUTEL (732-8835) or Call us at 1(877) PFCU4YOU (732-8496).

Night Drop Facility

For those times when you’re in a hurry, you can quickly and conveniently make deposits, loan payments, Visa® payments, and check orders in our Night Drop Deposit boxes. Currently available at most of our branches, these services let you avoid waiting in the teller line or conduct branch activities if you are unable to make it to the branch during business hours. And since these boxes are opened under dual control, you’ll have the peace of mind that your transaction is safe.

- Night Drop Deposits are processed and credited the next business day

If you have additional questions, please call us at 1(877) PFCU4YOU (732-8496).

Notary Services

A PFCU Notary Public will notarize documents for members with no fee by appointment only. Please contact your local branch to make an appointment for this service ¹

- ¹This service may not be available at all locations.

Safe Deposit Box

Safe Deposit Boxes are available at the following branches:

Decatur, GA

Duluth, GA

Lilburn, GA

Hoover, AL

Safe Deposit Boxes come in varied sizes. Annual rental fees vary based on size, subject to box availability.

| Box Size | Annual Fee |

|---|---|

| 3" × 3" | $30.00 |

| 3" × 5" | $40.00 |

| 5" × 5" | $60.00 |

| 3" × 10" | $75.00 |

| 5" × 10" | $90.00 |

| 10" × 10" | $125.00 |

Safe Deposit Boxes offer two keys for every rental. Lost keys may result in replacement fees and/or locksmith recovery costs if boxes must be forced.

Overdraft Protection

8 Reasons You’ll Appreciate Overdraft Privilege

- Added convenience

- A deposit you expected was delayed

- You have greater flexibility managing your money

- Unforeseen expenses drained your account balance

- Your chances of paying a merchant’s expensive returned-check charge are limited

- You made an honest mistake balancing your checkbook and now you’re short of funds

- You may avoid the embarrassment of a “bounced” check or a declined debit card transaction

- Other than our normal non-sufficient funds charges (set forth in our fee schedules), there’s no additional fee for this extra service

Surcharge Free ATMs

The Credit Union 24 (CU24) network allows you to use Credit Union 24 Here ATMs surcharge-Free. This provides availability to over Twenty Three hundred Surcharge Free ATMs nationwide.

Credit Union 24 Presto! Network which is the Credit Union 24 Select program, enables members of PFCU to enjoy over nine hundred additional surcharge-free ATMs at Publix Supermarket stores throughout the Southeast.

Shared Branching Services

PFCU also participates in the CO-OP Shared Branch network. This allows PFCU members to conduct their financial business at over 5,000 branches and over 2,000 self-service locations in all 50 states, Puerto Rico, Guam and military bases around the globe. You are never far from your money when you need it. Convenience is KEY in your busy life and we’ve got you covered. Click here to search for a CO-OP Shared Branch location near you.

It’s like having a PFCU branch where ever you go!

*There is a $4.00/transaction fee for business checking account transactions.

VISA® Debit Card

- Purchase goods and services from any merchant who accepts VISA and get cash back

- Amounts are deducted from your checking account similar to check clearing

- Use at ATM machines to make deposits and withdrawals to and from your checking account. Using CU24 ATMs is Free to PFCU members. Please note, PFCU belongs to CU24 Here, CU24 Select and Money Pass networks. PFCU does not belong to their Allpoint network.

- Honored by all merchants that display the VISA® logo

- It’s fast and convenient

Always choose “Credit”! It’s to your advantage!

When using your VISA® Debit Card for a retail purchase, you will be given a choice between debit (using your PIN) or credit (signature required). Be sure you always choose credit when you do not need cash back.

What’s the difference? In both cases the amount of your purchase will be deducted from your checking account. When you choose “debit”, you are not covered under the zero liability for unauthorized transactions. However, if you push “credit” you have coverage for zero liability on unauthorized transactions.

To Report Lost or Stolen Debit Card, Please call 404-297-9797 option 1.

Wire Transfer

Receiving Funds

There is a $5.00 charge for incoming wires. For instructions/information for the sender/payer to receive wire transfer in your account at PFCU.

Sending Funds

International outgoing wire requests must be made by 3:00 PM Domestic outgoing wire requests must be made by 4:00 PM. Both kinds of requests must be made Monday – Friday to go out the same day. International transactions may require a U.S. Correspondent Bank and may take longer to reach the receiving bank, based on their receiving process. There are service fees associated with this service.

TruStage Insurance

TruStage™ Life Insurance is issued by CMFG Life Insurance Company, MEMBERS Life Insurance Company, and other leading insurance companies. The insurance offered is not a deposit, and is not federally insured, sold, or guaranteed by any financial institution. Product and features may vary and not be available in all states. All guarantees are based on the claims-paying ability of the insurer. Corporate Headquarters 5910 Mineral Point Road, Madison, WI 53705. © TruStage

Call 1-800-814-2914 for more information.

Send and receive money with Zelle® in minutes*

![]()

Auto Loan

![]()

Home Lending

![]()

Digital Banking

![]()

High Yield Savings Accounts

![]()

Credit Cards

![]()

Wire Transfers